Written By: Aishwarya Sethi

What is a Start-Up?

While a startup is any new business setup, for it to be ‘eligible’ to avail government benefits under the Startup India Action Plan, a business must fulfil the following criteria-

- It should not have completed a period of ten years from the date of incorporation/registration.

- Is a private limited company or registered as a partnership firm or a limited liability partnership.

- Has an annual turnover not exceeding Rs.100 crore for any of the financial years since incorporation/registration.

- Is working towards innovation, development or improvement of products or processes or services, or if it is a scalable business model with a high potential of employment generation or wealth creation.

- It is not formed by splitting up or reconstructing a business already in existence.

How does one go about the registration process as a start-up in India?

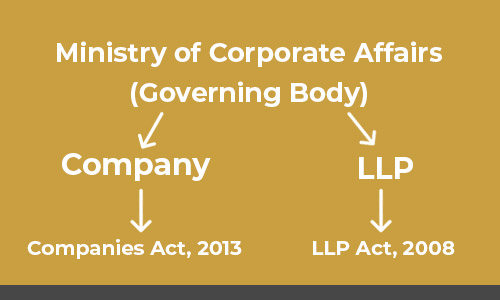

Step 1: Incorporate your business as a Private Limited Company/ Partnership firm/ LLP

Step 2: Register with Startup India, a simple online process to avail government benefits

Step 3: Get DPIIT Recognition online to avail benefits under tax law, procurement law, etc.

Step 4: Certificate of recognition is given within 2 days

What are the basic incorporation requirements for your entity type?

The incorporation process is the same for startups in India as it is for other businesses under the relevant acts, however, the registration of startups is a separate and easier process.

What are the tax benefits under the Startup scheme?

All startups which are ‘eligible’ under the Start-up India Program get manifold tax benefits including:

- A Startup incorporated between April 1, 2016 and 31st March 2022 is eligible for getting 100% tax rebate on profit for a period of three years in a block of seven years provided that annual turnover does not exceed Rs.25 crores in any financial year.

- A tax exemption on long-term capital gains if such a long-term capital gain or a part thereof is invested (maximum INR 50 Lakhs) in a fund notified by the Central Government within a period of six months from the date of transfer of the asset for at least three years.

- Funds which are not registered as venture capital funds, for example, funds from family, are exempt from tax.

Are specific approvals required?

For certain kinds of businesses, an industry-specific approval needs to be taken. For example, the registration of Non-banking Financial Institutions requires the prior approval of RBI; food businesses need licenses and approvals from the Food Safety and Standards Authority, etc.

What are the considerations which need to be kept in mind with regards to intellectual property?

The central government had also announced the Startups Intellectual Property Protection (SIPP) scheme in 2016 to enable entrepreneurs to protect their patents and trademarks. This scheme aims to help startups in India by giving them access to high-quality IPR services. This scheme is currently applicable until March 2022.

Benefits under the scheme (only for DPIIT recognized startups):

- For IP registrations, any facilitator on the panel can be selected and the startup is only required to pay the statutory fee and no legal or procedural fee to the facilitator under the scheme, thus bringing down the registration costs by at least 80%.

- 50% rebate on trademark filings

- Fast track patent registrations if request for expedited filing gets accepted. The process gets reduced to one year instead of six to seven years.

- Panel of IP facilitators to choose from.

What other benefits are provided to startups in India?

- Only a self-certification is required for certain labour and environmental law compliances initially.

- Startups can apply for government tenders and are exempted from the “prior experience/turnover” criteria.

- They can easily wind up within 90 days of the winding up application

Which documents are not required anymore for the registration of a startup in India?

- Letter of Recommendations

- Letter of funding

- Sanction Letters

- Udyog Aadhar

- MSME Certificate

- GST Certificate